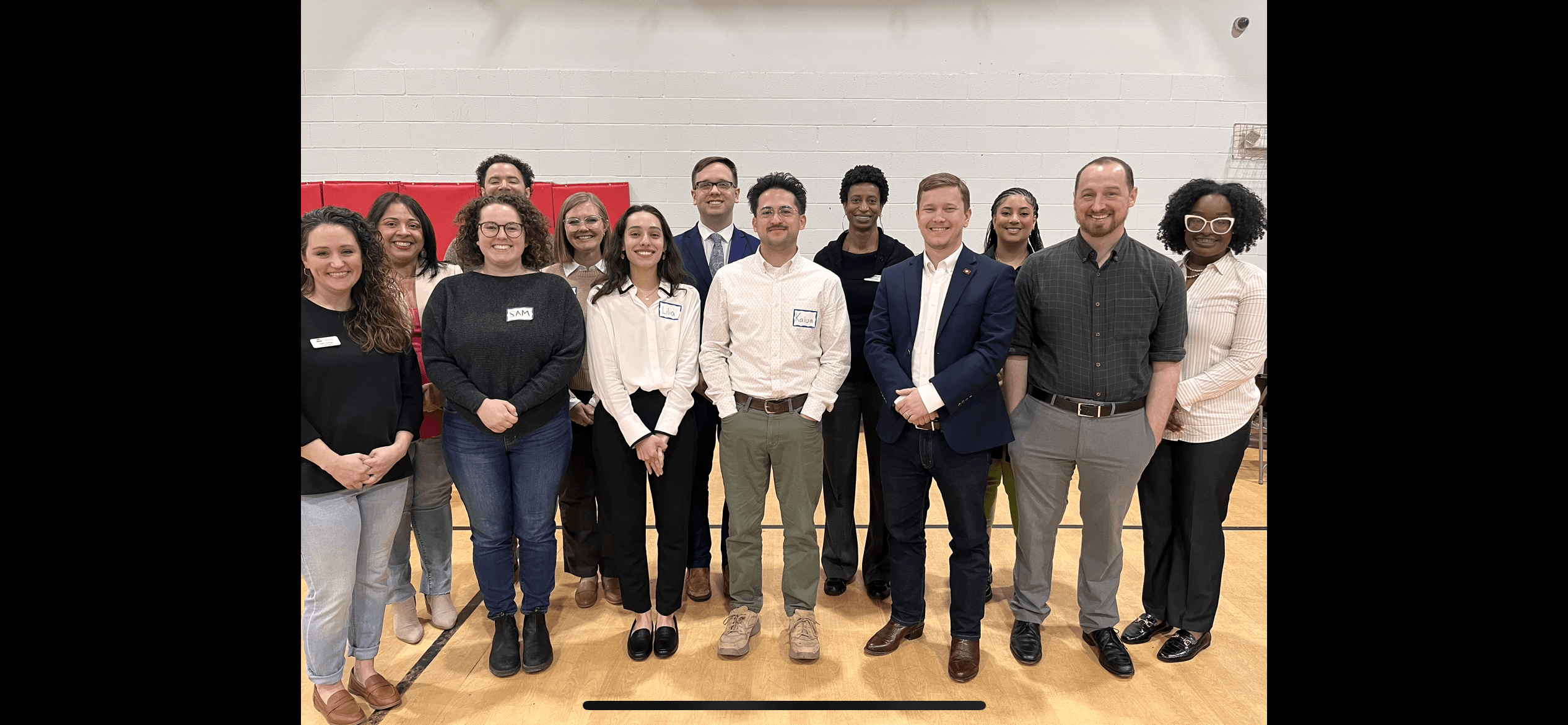

Apply for Legal Aid

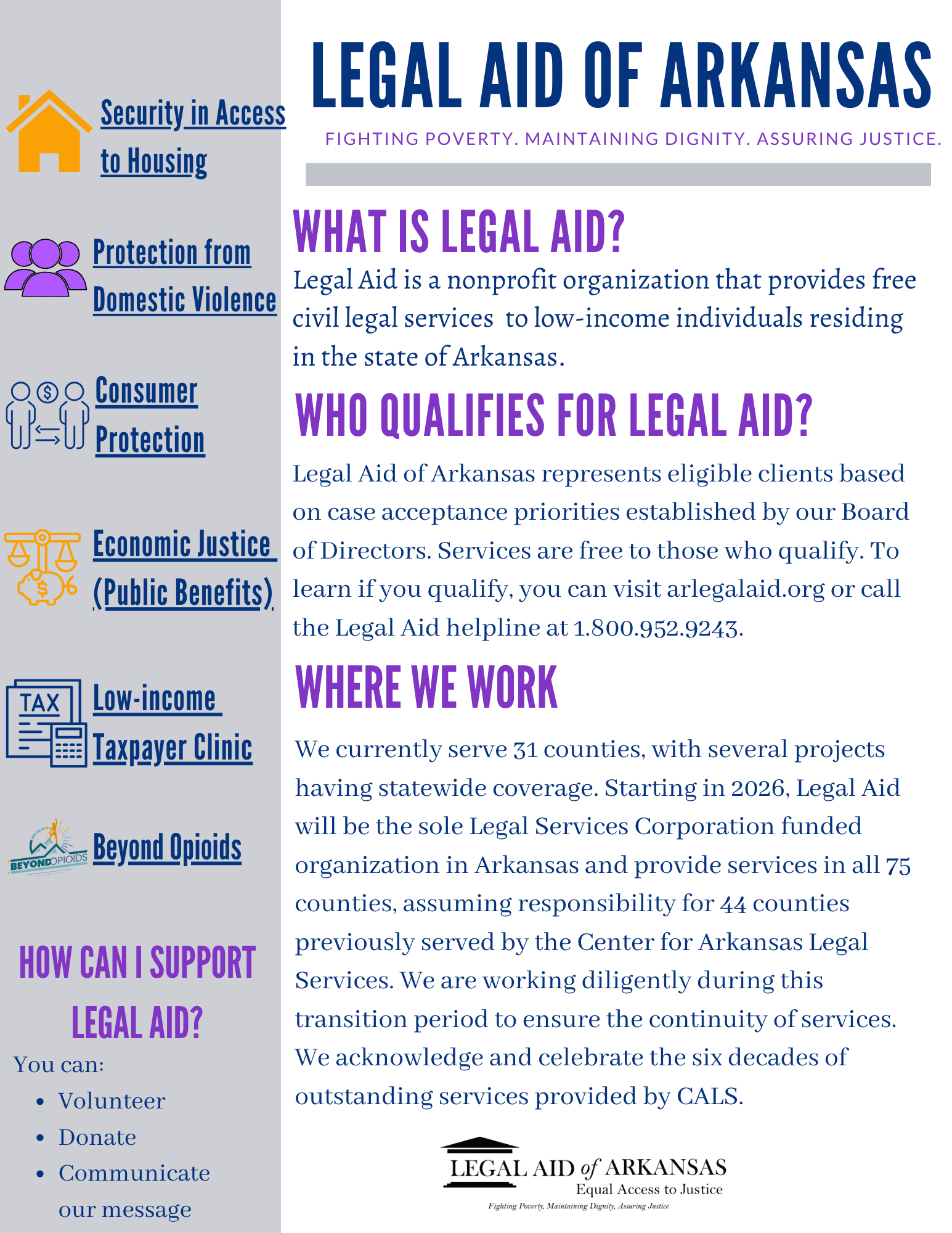

Legal Aid is a nonprofit, public interest law firm that provides FREE legal services to low-income Arkansans with civil legal problems. Apply Now!

-

Legal Services Corporation (LSC) provides funding to Legal Aid of Arkansas. To qualify for free legal help from a program funded by LSC, you must not have income and assets over a certain level. Our income eligibility guidelines are based on the Federal Poverty Income Guidelines. View our income guidelines here.

Due to limited resources, we can only accept cases that fall within our established priorities. Examples of these case type priorities include:

Guardianship;

Powers of Attorney;

Wills;

Orders of Protection;

Domestic Abuse;

Landlord/Tenant disputes;

Housing discrimination;

Contract disputes;

Debt relief;

Consumer matters;

Disability rights;

Employment rights;

Problems with public benefits, including Medicaid, Food Stamps, TEA, Medicare, SSI, child care, and subsidized housing;

End of life instructions;

Garnishments; and

Evictions.

If you need help with a legal problem, have a question you think a lawyer should answer, or have been sued and don’t know where to turn, contact Legal Aid of Arkansas! Use the menu links above to learn more.1-800-9 LAW AID (1-800-952-9243)

If you believe you have been a victim of housing discrimination (statewide), please call the direct fair housing helpline at 1-870-338-9834.If you meet the eligibility guidelines and would like to apply for legal aid, please click on the link below to be redirected to our online application.

Our Impact Last Year

-

8,161

-

$85,735.83

-

1,609

-

$107,158.56