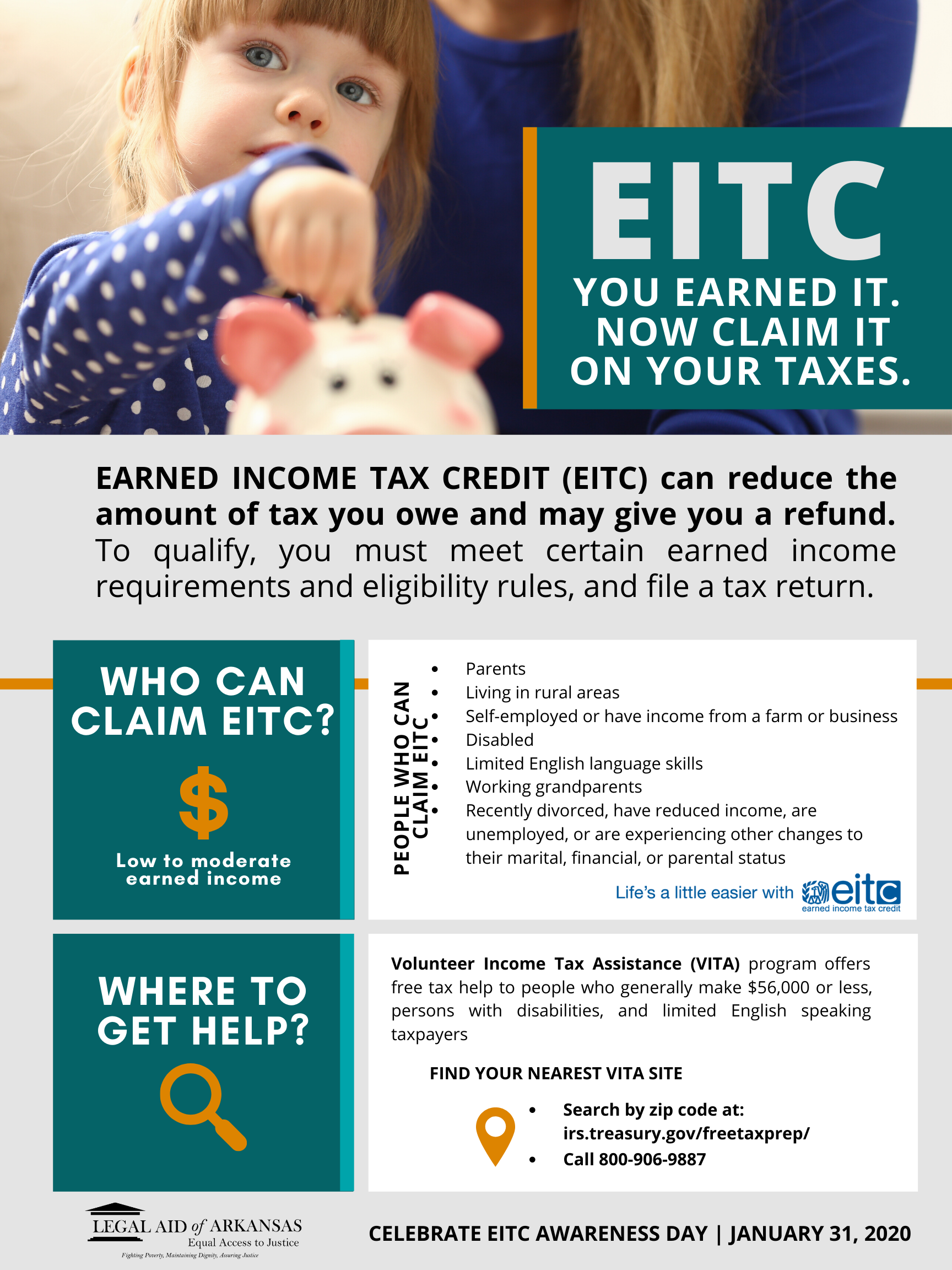

Workers may get a larger tax refund this year because of the Earned Income Tax Credit (EITC). But to get it, you must file a tax return and claim it.

January 31, 2020, marks the 14th anniversary of Awareness Day, a nationwide effort to increase awareness about EITC and who can claim it. This year, Legal Aid of Arkansas is promoting EITC Awareness Day and free tax preparation sites in Arkansas. Staff Attorney and Director of Low Income Taxpayer Clinic, Jennifer Gardiner, will be on Facebook Live! at @ARLegalAid on Friday, January 31st at 2:00 PM with more information about EITC, who’s eligible, and how to claim.

In 2019, 283,000 Arkansas workers received more than $764 million in EITC refunds. The average EITC amount per person was $2,700.

If you worked last year and had income of less than $55,952 check out your eligibility for EITC. EITC can mean up to a $6,557 refund when you file a return if you have qualifying children. Workers without a qualifying child could be eligible for a smaller credit up to $529.

“Billions of unclaimed dollars are left on the table each year. We want to get the word out to those who are eligible to file a tax return even if they don’t owe any tax to claim the EITC,” says Gardiner.

EITC varies by income, family size and your filing status. To be eligible, you must have earned income or certain disability income. This means you must have income from working for someone or working for yourself.

Volunteers – trained by the Internal Revenue Service – ask you the needed questions to find out if you qualify for the EITC and other refundable tax credits. Volunteers at Volunteer Income Tax Assistance (VITA) sites, also prepare and e-file (electronically file) your tax return at no cost to you.

Legal Aid does not prepare current year income tax returns. Please visit a free tax preparation site in Arkansas for the 2020 filing:

- VITA sites in Arkansas

- Find a volunteer free tax return preparation by zip code at IRS.gov Locator Tools