At the end of this week, states will begin to sever an anticipated 15 million low-income Americans from Medicaid rolls that ballooned to record heights because of a pandemic-era promise that people with the health insurance could keep it — a federal promise that is going away.

The end to the temporary guarantee that preserved the safety-net health coverage for the past three years saddles every state with an immense undertaking: sorting out which Medicaid beneficiaries actually belong. Around the country, officials have been preparing for months, but the result is a bumpy landscape consisting of states that vary in how ready they are for this daunting work.

Five states will start April 1 — the first date allowed under a recent federal law — to cut off beneficiaries who no longer qualify for Medicaid or have not provided proof they still deserve the coverage. Nearly all other states will begin to remove people between May and July. Already, almost half the states have set in motion the preliminary work of checking eligibility.

This Medicaid “unwinding,” as it is called, is a reprise of a pre-pandemic practice of requiring low-income people to demonstrate each year that they qualified for the coverage. But federal and state health officials and grass-roots advocates are bracing for what they say looms as the nation’s biggest health-insurance disruption since the Affordable Care Act came into existence more than a decade ago. That disruption is among the most profound ways the government is gravitating away from a pandemic footing, retreating from generous policies it adopted to help Americans in an emergency.

The scale of the undertaking has no precedent. The number of Americans relying on Medicaid has soared by about one-third — to 85 million as of late last year — since just before the coronavirus pandemic took hold in early 2020. Those who joined during that time did not need to pay attention to renewal notices from their states — which now could cost them their insurance.

And within state governments, many Medicaid agencies are strained by shortages of eligibility workers and call-center staffers to advise beneficiaries, while employees hired in the past three years have not until now needed to learn how to conduct renewals.

Given these and other challenges, the unwinding has led to an unparalleled choreography between federal health officials, who oversee the program, and states, which set many of their own eligibility rules and carry out the ground-level work. Biden administration appointees are prodding states in hopes of avoiding a surge in the nation’s uninsured.

“We go to sleep at night thinking about this and wake up in the morning thinking about this,” said Daniel Tsai, Medicaid director at the federal Centers for Medicare and Medicaid Services (CMS). For months, Tsai said, his team has been hosting calls every Friday afternoon “with 300 of our best state friends, wrestling with some of these things.”

The goal is twofold: to coach states to avoid cutting off people improperly for procedural reasons — such as a renewal letter that never arrives because someone has moved — and to design easy paths for people who no longer belong on Medicaid but could migrate to other insurance. Federal officials have told states to try to figure out who is eligible by matching electronic records of wages and other benefits such as food stamps, rather than relying on individuals to respond to renewal notices.

Still, according to a recent Department of Health and Human Services analysis that predicts 15 million people will lose Medicaid, an estimated 6.8 million of those beneficiaries will be removed even though they still are eligible.

“We are very worried about most states,” said Joan Alker, executive director of Georgetown University’s Center for Children and Families.

The first states to start are Arizona, Arkansas, Idaho, New Hampshire and South Dakota. By the end of the unwinding — supposed to take 12 to 14 months in each state — more than 5 million children will have lost Medicaid, according to the HHS analysis, which also predicts that Latino and Black beneficiaries will be disproportionately removed.

As the unusual guarantee of continual coverage ends, a spike in the uninsured is especially likely in 11 states, largely in the South, that have not expanded Medicaid under the ACA to people with somewhat higher incomes. Because those states tend to make only the extremely poor eligible for Medicaid, they will have many people who make too much to qualify for the government health insurance but not enough to reach the income needed to get federal subsidies to afford health plans sold on ACA marketplaces — the coverage the administration is counting on as the main fallback.

The toll will be large, too, in 13 states that have not chosen to extend Medicaid benefits to women for a full year after they give birth.

Texas falls on both lists.

That means the unwinding almost certainly will strand Connie Bunch, a 38-year-old single mother who lives in Austin with a 10-year-old daughter with cerebral palsy and a 15-month-old son — and who recently discovered medical problems because she has been able to afford doctors since her second pregnancy ushered her onto Texas’s version of Medicaid. Under the state’s normal rules, Bunch would have lost that insurance two months after her baby, Aiden, was born Christmas Eve 2021. Under the pandemic rules, she has been on Medicaid ever since.

“That has probably saved my life,” Bunch said.

After growing up on Medicaid, Bunch said in an interview, she was uninsured for a decade until she could rejoin when she was 28 and pregnant for the first time. Her blood pressure spiked dangerously late in that pregnancy, contributing to daughter Brooklyn’s birth complications and cerebral palsy.

Caring for a disabled child with epilepsy and developmental delays has made it difficult for Bunch to work. The one time she found a position with health benefits, at a state-run facility for children with disabilities, the job lasted less than two months.

Feeling unwell one day, Bunch went to the infirmary, which found her blood pressure soaring. She could not afford medicine to lower it. She was not allowed to return to work without being medically cleared. Every morning, she stopped at the infirmary for a blood-pressure check. After a few weeks of failing the daily checks, she was asked to leave.

At times, she saw a doctor and scraped together money for the bill while living mainly on her daughter’s disability benefits. Mostly, she went without care, until she learned in May 2021 that she was pregnant again and returned to Medicaid. It has allowed her to afford medicine for her blood pressure and diabetes.

And because she was still on Medicaid seven months after her son was born, she went to an emergency room one July night when the right side of her face suddenly was drooping. She feared a stroke. It turned out to be Bell’s palsy, but tests at the hospital also found several small aneurysms in her brain — not life-threatening but needing doctors to watch them. She has seen a neurologist and a neurosurgeon. And a cardiologist for her heart palpitations. And had a hysterectomy because she has been warned another pregnancy could be unsafe.

In the summer, she began elaborate preparations for bariatric surgery that doctors have advised for weight loss. Having heard about the unwinding, she had the surgery this week. But she will need follow-up care, and she has no idea how she will pay for it once Texas reverts to its two-month post-pregnancy rule.

All of which is why she nervously ventured into a Texas House of Representatives hearing room in March and described her life to a committee debating a bill that, even if it wouldn’t help her this long after Aiden was born, would offer a year of Medicaid benefits to other new mothers.

Bunch is one of 2.7 million people the Texas Health and Human Services department estimates are on Medicaid only because of the pandemic guarantee. Patient advocates and health-care groups are fearful about the department’s plan to decide the insurance fate of those beneficiaries faster than federal officials have recommended. The state has announced it expects to complete reviewing them by September.

“It will still be a challenge … with so many renewals front-loaded into the first half of the year allowed,” said Stacey Pogue, a senior policy analyst for Every Texan, a policy and advocacy group. “[M]istakes could get made.” She noted that, because of staffing shortages, the state has been processing just half of new Medicaid applications lately within the required length of time — and that is before the unwinding begins.

Even in the best-prepared states, dislocation will be marked.

The Massachusetts legislature has given a $5 million grant to Health Care for All, a Boston consumer health organization, to run an extensive outreach campaign, alerting beneficiaries all over the commonwealth they will need to pay close attention to robins-egg blue envelopes with renewal notices. MassHealth, as Medicaid is called there, is doubling its customer service representatives, plus hiring 100 temporary workers to help handle renewal paperwork. It is alerting a Medicaid patient’s main doctor once a renewal notice is sent.

An additional $1 million is being devoted to counselors focused on helping people cross the bridge from MassHealth to the ACA marketplace, when they start leaving Medicaid in June. The Medicaid agency is collaborating with the state’s marketplace to set up a van that will go into communities to help people sign up for an ACA health plan.

“A lot of this is about protecting universal coverage in Massachusetts,” said Mike Levine, the commonwealth Health and Human Services department’s assistant secretary for MassHealth. In 2021, 2.4 percent of Massachusetts residents were uninsured, the lowest rate in the country.

Despite its tradition of insurance and its preparations, Massachusetts estimates 300,000 people will lose Medicaid through the unwinding. It is too soon to know how many will get other coverage. “What makes it harder,” Levine said, “is there are a lot more members, and we’re out of practice.”

The unwinding will test the Biden administration, as well as states.

The three-year guarantee of Medicaid, a shared financial responsibility of the federal government and states, was an early legacy of the pandemic. The first coronavirus relief law offered states extra federal money to help cope with a surge of Americans losing jobs and health benefits at the pandemic’s beginning. The extra money would flow only if a state promised not to remove anyone until the end of a national public health emergency HHS had just declared. Every state promised.

That emergency is scheduled to end in May. But a broad law adopted by Congress just before Christmas detached continual Medicaid from the covid emergency, establishing the April 1 date. The law compels each state to report monthly data to federal officials, and it requires CMS to monitor it carefully. It gives HHS Secretary Xavier Becerra powers to intervene if a state’s unwinding methods break federal rules.

The data includes the number of beneficiaries whose eligibility is reviewed each month, the number of people kept on Medicaid and the number jettisoned and, of those jettisoned, the breakdown between truly ineligible vs. removed for procedural reasons. States must report how many beneficiaries called with questions, the average wait time on hold and how many simply gave up.

CMS must make all this information public. Tsai said the agency will release it “as soon as we have that information from the states and make sure it is accurate,” noting that most states will not hand in their first monthly report until summer.

Advocates and some congressional Democrats are pressing federal officials to provide a quicker glimpse of what is happening — and to step in swiftly if many people are losing Medicaid in error.

HHS “must take bold steps to prevent this looming crisis,” said Rep. Nanette Barragán (D-Calif.), chair of the Congressional Hispanic Caucus, one of three Capitol Hill caucuses for people of color urging Becerra to prevent the unwinding from aggravating disparities in coverage and health.

As April 1 nears in the first states to thin their Medicaid rolls, advocates say many people at risk of losing their insurance are not aware of what is about to happen.

In Arizona, the Children’s Action Alliance leads a coalition trying to spread the word, reaching out to houses of worship, radio stations, places where clusters of homeless people have mailboxes. “We are pounding the pavement,” urging people not to ignore plain white envelopes the state started mailing in February, said Kelley Murphy, the alliance’s vice president of policy.

Still, Murphy said, “We worry we are going to have a rash of situations where someone shows up at an emergency room and realizes they are not covered.”

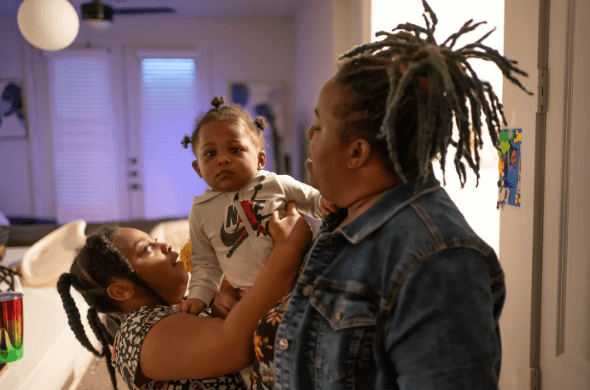

In Arkansas, which also has an April start date, the state’s unwinding plan says 587,000 people on Medicaid do not belong — roughly half the caseload. As in Texas, Arkansas plans within a few months to evaluate about three-fourths of that group. The state anticipates that 3,500 people a month will lodge appeals contesting their removal, five times as many as the state typically handles.

“We’re dreading it, in a way,” said Trevor Hawkins, a lawyer for Legal Aid of Arkansas. Since the unwinding’s renewal notices started going out the first weekend of February, few people have called Legal Aid for help. That suggests, he said, that people aren’t opening the envelopes or don’t understand the letters’ importance.

The deluge of help-seekers, Hawkins expects, will come once people receive a “notice of action,” ending their eligibility.

“I get nervous thinking about it,” he said.

This article has been updated to include more detail about Arkansas’s Medicaid unwinding plan.